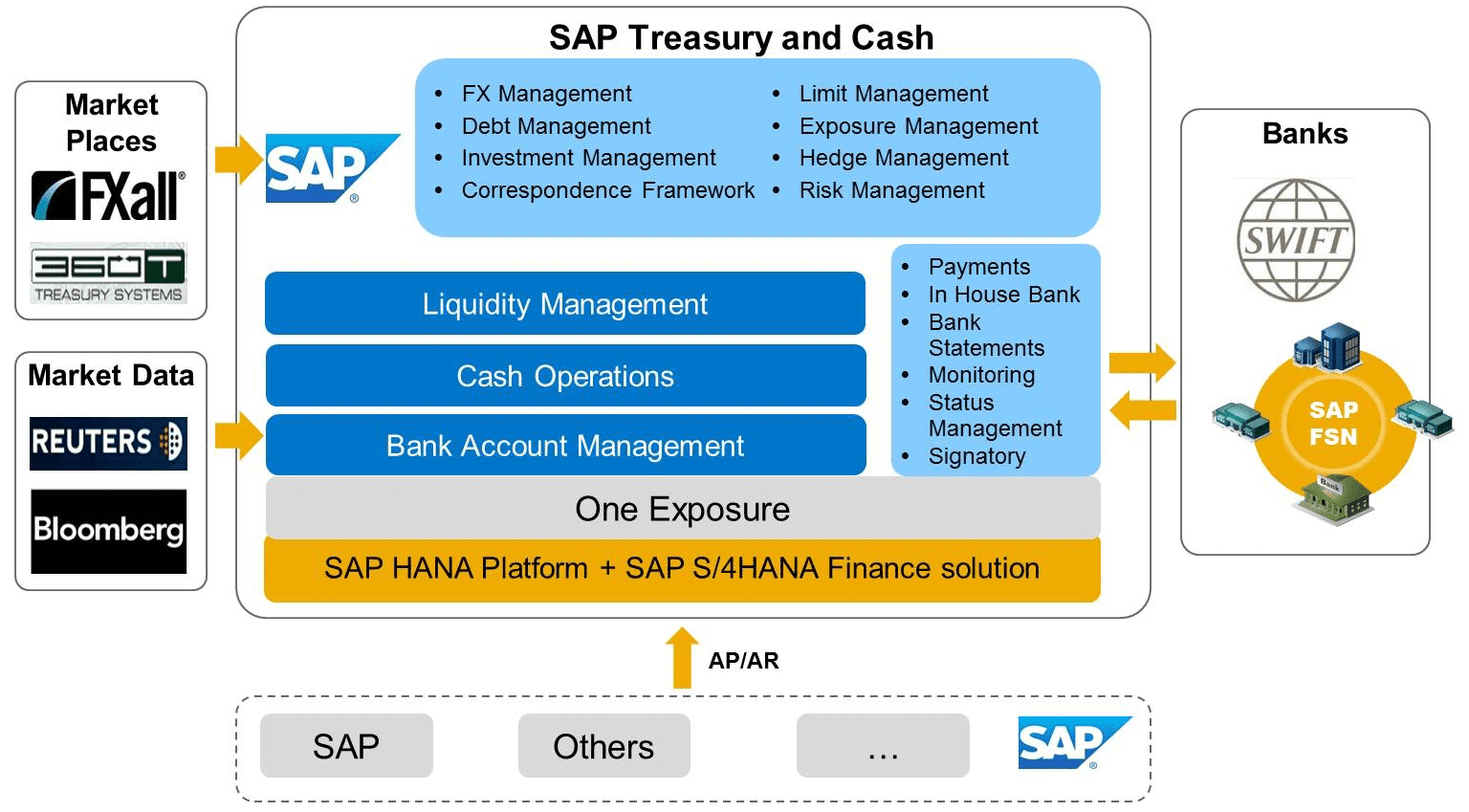

In any organization, the key function is Cash and Banking process Management. Maintenance of proper bank accounts, timely receivable collections and to plan & make payments against account payables timely, are all important functions of the Cash Management process. SAP has brought an Integrated Treasury and Cash Management solution on the S/4HANA Platform. Please do note that in S/4HANA, SAP Cash Management is separate license solution, please do refer to SAP Engagement Team, for more information regarding licensing process.

Credit : SAP SE

- Bank Account Management (BAM) – handling of Master data, approvals, payments, Bank statements upload/download operations.

- Cash Operations – daily cash inflow & outflow management, monitoring “Bank Risks” and workflow of payments approvals and monitoring of payments

- Liquidity Management - complete management of funds for the medium term until the end of year onwards

- Part 1 - providing information on the “functionality available” for a typical Cash Manager perspective.

- Part 2 - providing information on the important “configurations & customizations” necessary in Cash Operations.

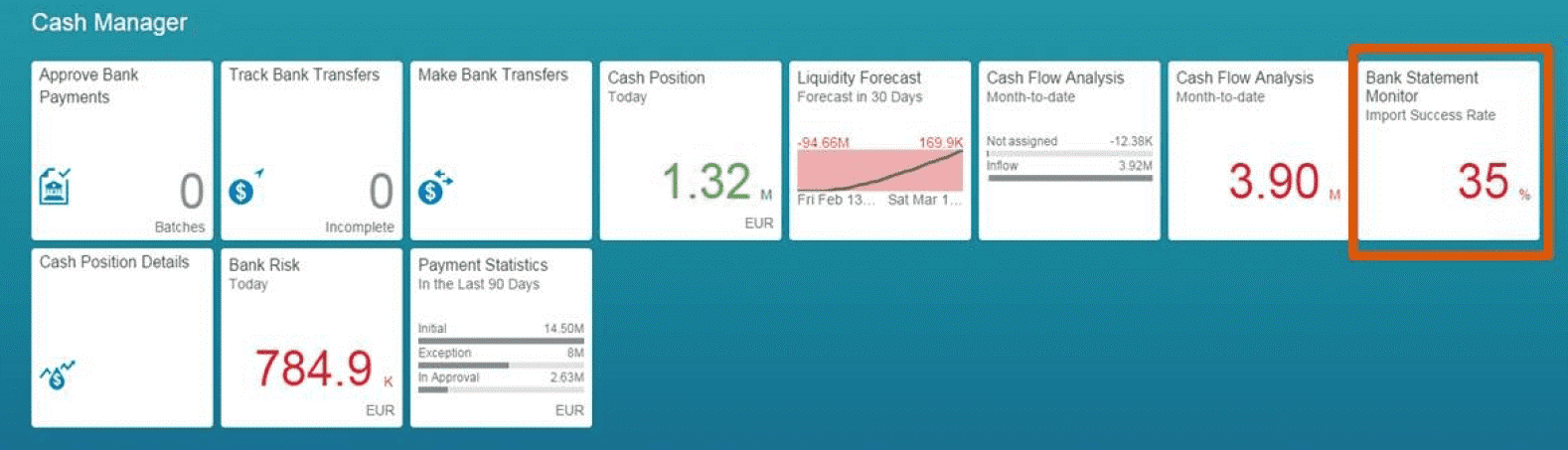

Typical Cash Manager role consists of the following responsibilities:

- Import all bank statements into SAP, monitor and ensure successfully

- Monitor the cash position of the organisation in Bank and in-hand, proactive cash position analysis ensuring that cash balance is in order

- Planning cash transfers based on forecasts and past cash & bank operation analysis, perform bank transfers between various banks thereby balancing “Bank Risk”

- Monitoring and approving payment approval requests for bank transfers and outgoing payments

To perform efficiently, several Fiori Apps have been provided by SAP S4 HANA. Please do refer to the illustration displaying the Cash Manager role-related standard Fiori apps.

Credit : SAP SE

This app offers and displays the overall status of the various bank statement imported from all the banks. If any error while importing bank statement is displayed in the monitor, then responsible person/user to follow up and resolve the error. App has features to send out mails to the concerned user. Cash Manager is able to monitor specific transactions with the help of these views like “By Country, By Company, By Bank, By Bank and Company, By Bank Account”.

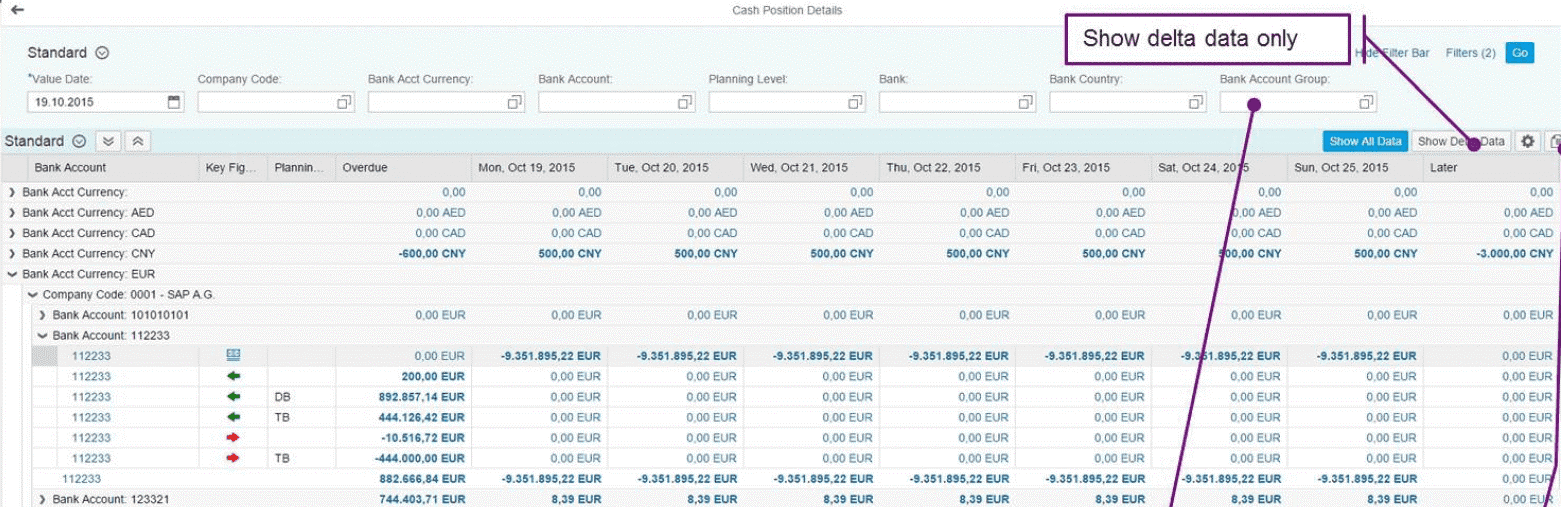

App displays summary of cash amounts in different views. View examples are “By Company, By Currency” and other views. The overdue days due are displayed as “Overdue (60 days before value date)”, The Cash Manager can click on the links to find further details as and when required by him.

This app displays the details of all transactions, from the cash flow, with hyperlinks available with several data points like document number, amounts etc. Cash Manager can analyse the original transaction documents, like MM, SD, AP, AR, PO, Journal entries etc., helping them to find the error documents or exceptional transactions.

The Make Bank Transfer app helps in performing bank transfer of funds aligning with the planned allocations for different bank accounts. On selecting the source and target the bank accounts, transfer amounts, method of payment and clicking the “Make Bank Transfers” option. Similarly, “The Track Bank Transfer” - Fiori ID: F0692 app displays the bank transfer detailed transactions, alongwith the different status display like “in approval, approved, sent to bank, completed” against each transfer.

The Cash Manager with the help of this app, can have an overview of the payments made, as well as analyse payment statistics, using various parameters like “company, status, bank, etc., Have a detailed display of data using hyperlinks.

Summary:

To recapitulate, “Cash Operations” is a simple, automated & streamlined functionality from SAP in the Finance module. New features added in the S/4HANA 1809 release.

- SAP Education module – S4F40

- Configuration Guide for SAP Cash Management

- Data Setup Guide for SAP Cash Management

- Latest release 1809 – New Features for Cash Management and BAM