Is your organization TAX compliant and ready?

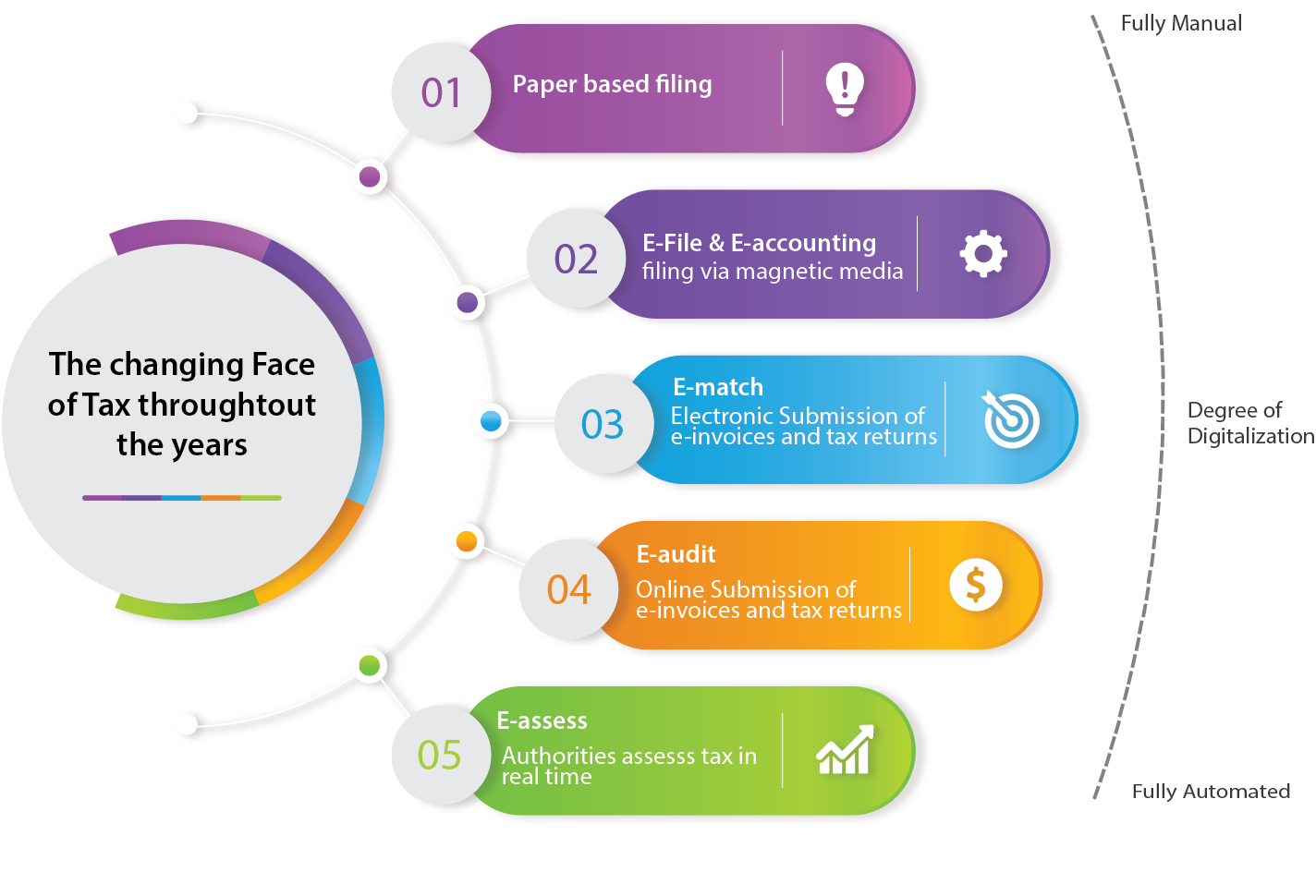

“Enterprises are defining their TAX Implementation Roadmap by driving to the “digital “transformation”; are” principally changing the processes of how invoicing will be done, tax collected, reporting, deposit taxes and become Statutory Governance & tax compliant. Continuously planning and controlling with respect to ever changing business scenarios.

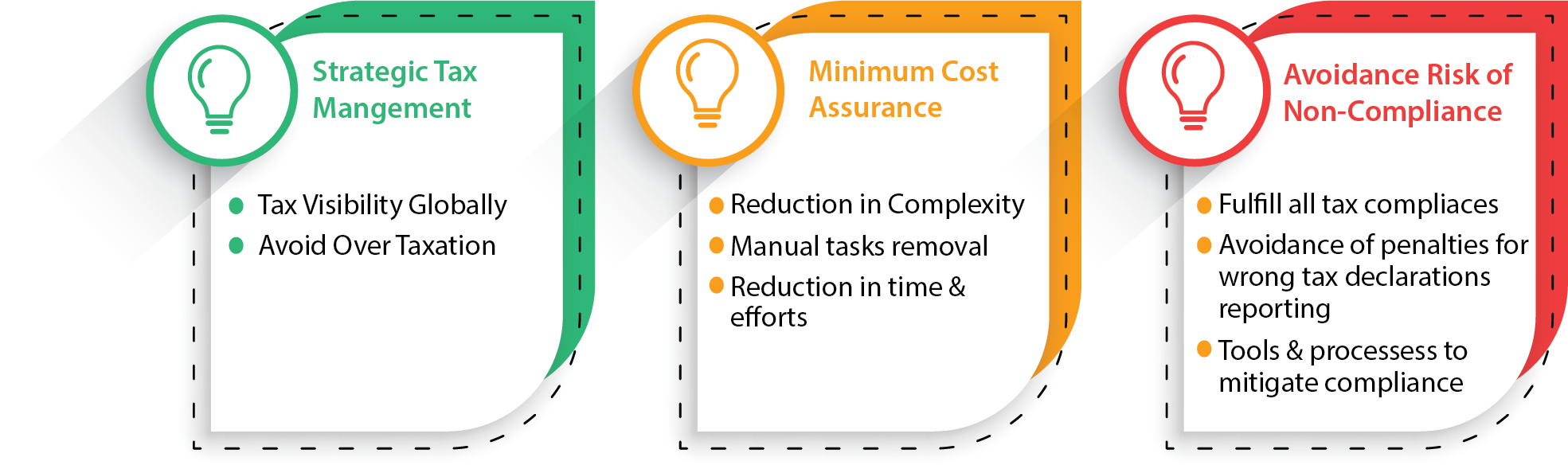

In the current era, tax departments are under pressure to add value to the business and to transform into a Real-time, data-driven tax activity sowing to the constant evolution of local statutory protocols and governance rules as well as business scenarios. To help the “Enterprises Taxation Roadmap”, Nexus has the knowledge to guide enterprises to successfully transform their taxation process and the technology to enable this transformation. Insight was delivered from the various studies & knowledge brainstorming conducted during the successful taxation project implementations, which have shaped out our SAP Taxation solutions.

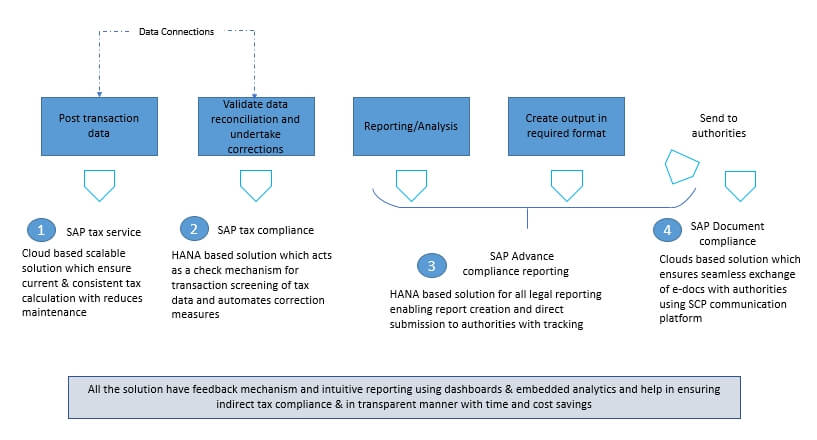

Enterprises need to maintain Statutory Governance compliances and as well as need to submit periodically real-time transactional data like filing of returns and reports to the Statutory bodies. Advanced compliance reporting (ACR) from SAP solutions permits the clients to submit reports to the tax authorities via VAT returns/SAF-T, analytics, and workflows. The solution is flexible and tailor able to client’s requirements in various countries the company has its operations. Maintains the various types of forms &Analytics which provide insights into how tax is reported across the world, also providing the feature of an “audit trail” to satisfy all whether internal and external auditors. ACR &SAP Document Compliance together, helps the business to meet all its periodic reporting commitments thereby fulfilling the statutory government requirements in real time. Our Taxation process solutions add value in:

Communication to Authorities

- Tax services- Calculations, Application & customized programs

- Document Compliance –Relevant tax content (e-Invoicing)

Internal Controls

- Tax compliance - Managed tax services-error identification & rectification

- Advances compliance Reporting-Global statutory reporting

Real-time transactional data submitted to the authorities, helps them to verify and confirm the submitted data periodically and thereby revealing fraudulent & inconsistent data.

Nexus has successfully implemented VAT compliance business process solutions in several countries around the world.

- Kingdom of Saudi Arabia - VAT implementation

- UAE VAT implementation

- Bahrain VAT implementation

- Singapore GST implementation

- India GST Implementation

Procurement & production

- Supplier’s pricing

- A/P invoice processing time

- Purchases from non-registered GST/VAT businesses

- Education of suppliers

Sales & Marketing

- Samples/marketing

- Pricing strategies

- Returned goods

- Education and communication to consumers

- Billing

Finance

- Bad debts

- Deposits/ advanced payment

- Leases and hire purchase

- VAT return preparation

- Disposal of assets

- Sales of scrap

Human resources

- Fringe benefits

- Gifts to employees

- Employees allowance and claims

Legal

- Existing and new contracts

- Are any payments based on revenue/ turnover (franchise or royalty arrangements)?

IT

- System changes

- Documentation (Tax Invoices)

- Reports for VAT return

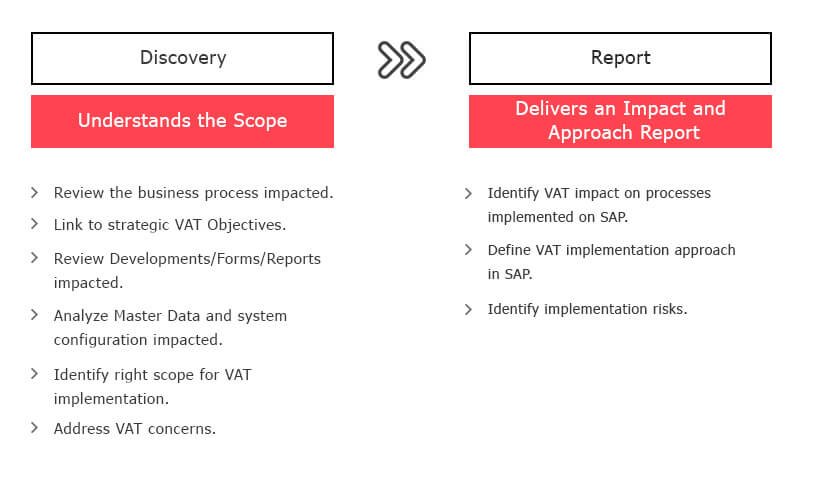

The Nexus Tax Compliance methodology implementation is built on structured, agile & flexible framework. From our successful implementation has provided us confidence that we and our methodology approach is a clear differentiator compared to other competitors.

Internal Controls :

- SAP Tax compliance

- SAP Advances compliance Reporting

Infrastructure & hardware assessment

Risk Assessment

TAX compliance scenarios

DATA model modification

Routine implementation checks

SAP Tax compliance workflows & Reports

Setup of SAP Tax compliance landscape

Custom Dashboards

Training & Documentation

-

It is known for its precise SAP GST /VAT Country Localization service.

-

Nexus has successfully completed the project of VAT implementation for the UAE based companies.

-

Nexus is known for having a pool of experienced VAT implementation professionals.

-

Team of Nexus has good experience in delivering the GST Rollout for a large number of Indian companies.

- Plan and Analyze - Nexus will first prepare the ERP system of your enterprise for VAT and will consider all the other implication that will be affected by this change.

- Accessing the Impact of VAT - Try to evaluate the impact that your business and other internal processes will have to bear by the implementation of the VAT.

- Implement the VAT Enabled SAP Solution – Customize the configuration of SAP and Connecting with the SAP’s TaaS with the help of SAP Localization Hub are the two approaches in this step.

- Go Live with the Tweaked System - Once Nexus have trained your staff, then your SAP system is ready to go live. Make sure that the SAP system implemented is Liable for VAT compliance.