Financial Forecast Accuracy

Access to financial data by integrating profitability and cost analysis into operations for full transparency

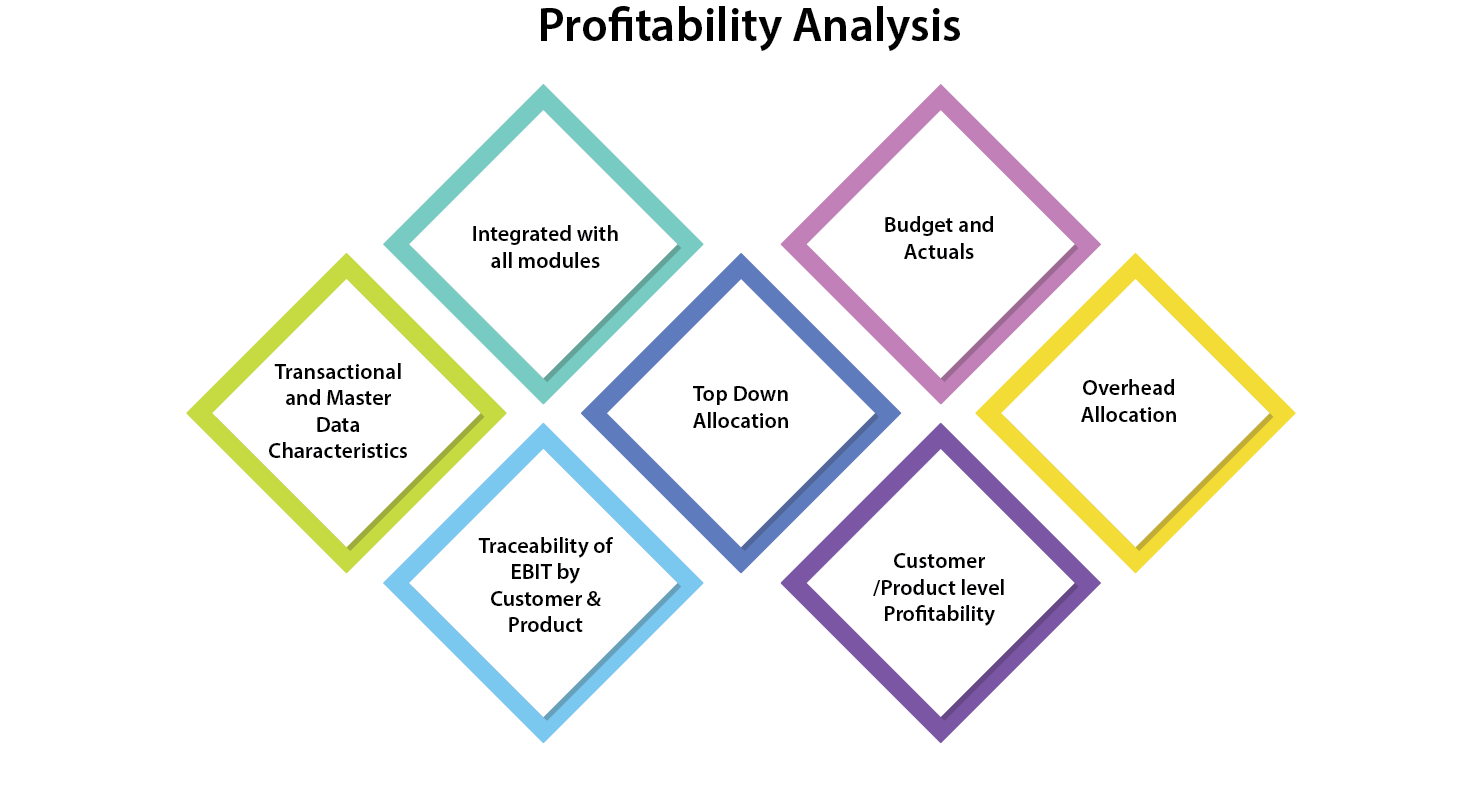

Organisations keep talking about profitability analysis; the organisations consider various different ways or conducts that how the profitability of a business is to be measured. In this regard, there is an external view and internal view of profit for any business organization; external view of profit components are mostly number of statutory, tax, and regulatory requirements, whereas the internal view components are the management requirements of how business units, products, and customer segments are performing.

CO-PA is the solution that is providing the internal view of profitability, and is one of the most stable and sturdy functionalities of SAP which many customers have implemented. The integration capabilities of SAP ERP, the data flow to CO-PA is heavily dependent on other SAP modules like Sales and Distribution (SD), Product Costing (COPC), Production Planning (PP), Material Management and so forth.

Enterprises who have the challenge of finding the right tracing and measurement factors to proper allocation of indirect costs implement CO-PA to create a gross margin view rather than a full profit and loss (P&L) view. Real value for any enterprise is the ability to slice and dice “profitability” via different and various measurement dimensions, including customer, product, customer group, division, distribution channel, sales organization, and brand.

SAP S/4HANA has brought a pervasive change for the betterment in multiple areas in which enterprises operate, like speed, mobility, user experience, and interconnectivity. Specific to CO-PA applications, SAP S/4HANA caused a paradigm shift and made transformational changes like usage of the Universal Journal, elimination of reconciliations, improved end-user experience, real-time close and thereby benefiting the customer.

If any enterprise is migrating to SAP S/4HANA, then that customer can continue using costing based COPA but should keep activate account-based CO-PA, as history migration is not possible therefore retain the costing based for a certain period.

OCOPA has been rebranded as Margin Analysis in SAP S/4HANA. Whereas ECC has either Cost based COPA active or Account based COPA active; how it will work when the enterprises start replicating or migrating to SAP S/4HANA in Central Finance Scenario. Focusing on to understand the important and major changes that has been improvised in COPA solution in SAP S/4HANA, which is now known as Margin Analysis.

SAP has been in the COPA evolution process; and Profitability Analysis (COPA) is the most important area for complex management reporting. Majority enterprises are using “Costing based COPA” because this is a “Value Fields” based, and as this is based on Value Fields and not on “G/L Accounts”, numerous times it does not completely align with the “GL Document postings” and therefore was not simply reconciled with General Ledger. It is always challenging at the month end reconciliation.

| Functionality | SAP ECC | SAP S/4 HANA Cloud | SAP S/4 HANA On Premise |

|---|---|---|---|

| Account Based COPA | Usable | N. A. | N. A. |

| Costing Based COPA | Usable | N. A. | Usable |

| Combined COPA | Usable | N. A. | N. A. |

| Margin Analysis | N. A. | Mandatory | Recommended |

| Functionality |

SAP S/4 HANA

|

|||

|---|---|---|---|---|

| Top-down Distribution | Yes | Yes | ||

| COGS (Cost Component) Split | Yes | Yes | ||

| Production Variance Split | Yes | Yes | ||

| Statistical Sales Conditions | Yes | Yes | ||

| Reconciliation (FI-CO) | No | Yes | ||

| From P&L to Characteristic Drilldown | No | Yes | ||

| Profitability Characteristics on Balance Sheet items | No | Yes | ||

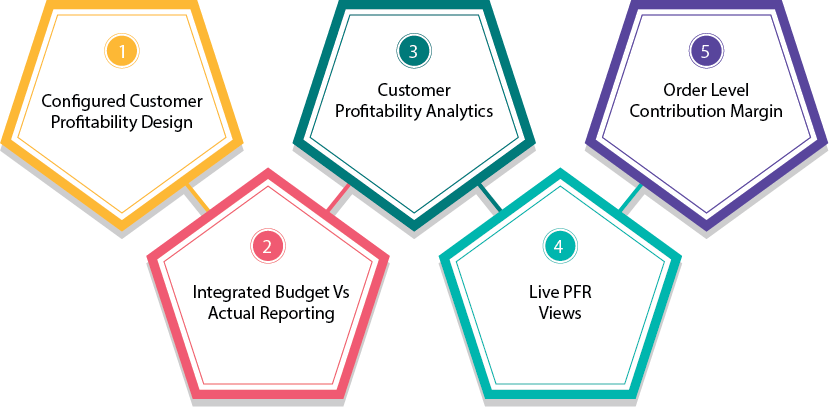

Achieve a significant improvement in the information content of your profitability calculation and use the advantages that SAP Margin Analysis offers you.

Profitability analysis - encompasses evaluation of profit, or margin contribution by market segment or by strategic business unit.

Access to financial data by integrating profitability and cost analysis into operations for full transparency

Budgeting and forecasting cost Business & operations analysis/reporting cost by providing flexibility reporting

As part of a compact evaluation, let us help to determine at which points the controlling needs optimization and what measures need to be taken, how can we implement and support your business needs. Contact us.