GST is the goods and services tax - a value-added tax levied on most goods and services sold for domestic consumption This tax levy will touch the Tax Occurrence, Tax Compensation, Tax Structure, Tax Compliance, Calculation, Reporting and Credit Consumption leading to a complete makeover of the existing indirect tax system.

Reconciliation is comparison of two sets of data entries to detect any differences or variances, to avoid and correct the unintended mistakes committed or any omissions. Reconciliation process is very critical process under taxation, as it informs short tax paid or not even paid or excess paid as well.

Different type of mismatches or differences after matching and reconciliation exercise:

- Differences between the input tax credit amount publicized in GSTR- 3B and the GSTR 2A/ GSTR-2B

- Discrepancies in sales details between GSTR-3B and GSTR-1

- Differences in the interim credit as claimed under CGST Rule 36(4) and the actual credit that is claimable as per GSTR-2B across return periods.

- Differences in the input tax credit between the values recorded in the books of accounts and amount available in GSTR-2B

- Differences in sales details between the ledger accounts and GSTR-1 auto-populated from the e-invoicing system.

- Difference in tax payable upon comparing the auto-populated GSTR-3B with the books of accounts.

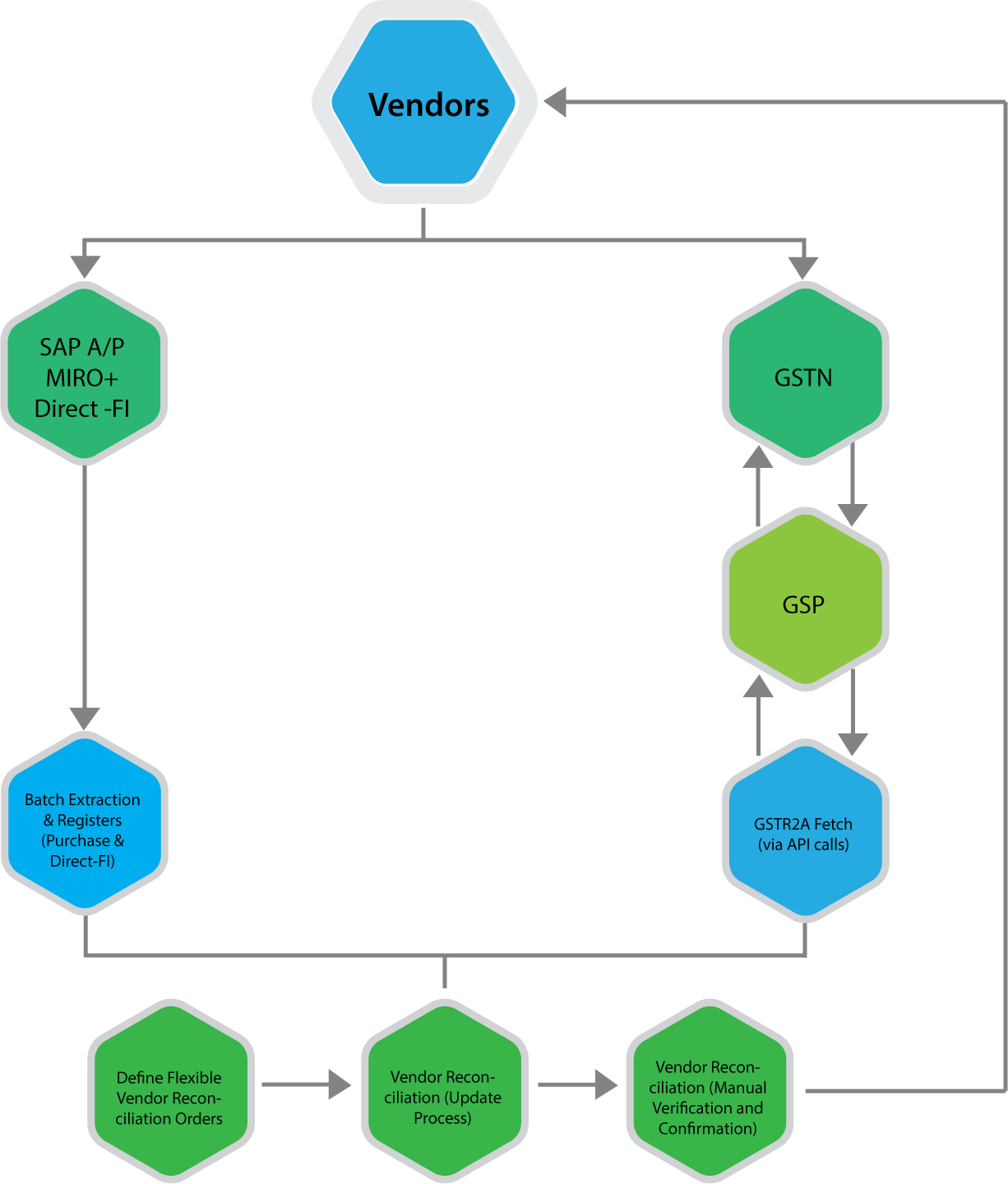

Companies avail input tax credit on the vendor invoices posted in their Tax ledgers. The GST tax administration has moved towards permitting input tax credit based on vendor’s GST returns. This change is posing a challenge on the cash flow and reconciliation of earlier settlement years. GST Reconciliation solution from Nexus is a solution serving enterprises to prepare their vendor reconciliation process easily.

| SAP GSTR1 | SAP GSTR2A/2B | SAP GSTR3B |

|---|---|---|

|

Nexus SAP GST solution is the definitive solution managing all aspects of Goods & Services Tax Management.

|

Nexus SAP GST solution is the definitive solution managing all aspects of Goods & Services Tax Management.

|

Prepare GSTR3B data automatically in SAP system. Reconcile the data with 2A/2B & GSTR1 in SAP. Simultaneously, find the variance and reconcile auto populated 3B data from GSTN Portal in SAP.

|

Cost-effective solution:

- No need for a separate ASP environment system

- No increase in solution cost in future, due to business volume and growth

Information security:

- Solution is installed in the same instance of SAP

- Secured data encryption - unified encoding and encryption of data

Capability and track record:

- Enterprise customers - Deployed and supporting under AMC,

- Addressing and updating patch changes as and when introduced by GSTN

Compliance & Cashflow

- Missing documents & value-mismatches identified

- Addresses special-char issues in Invoice numbers Handles cross-registration invoices Read More

- Vendor evaluation & better follow-up with vendors using reconciled data

- Establish payment controls in A/P process

- Trace & fix root causes to prevent future mismatches

- Trace eligible ITC not posted in A/P

- Reduce Tax liability

- Improved cash-flow & saved interests costs

Request for a Complete Product Walkthrough