In the US, tax reform is high on the agenda of the new federal administration, and in Latin America, pressure on tax authorities to boost collections and their increasingly sophisticated use of technology is transforming indirect tax compliance. Indirect tax environment is continuously growing more complex across the Americas region. With an extraordinary amount of indirect tax reforms globally, increased broader tax base, and increasing tax rates worldwide, more America region-based enterprises are analyzing the indirect tax obligations – including value added taxes (VAT), sales and use taxes, goods and services taxes (GST), federal excise taxes and other transaction taxes.

- Indirect taxation rates definition, including VAT, GST and consumption taxes

- Tax rates for withholding taxes definition

- Specifying tax codes to be implemented in the system

- Tax perspective classifying system limitations and proposing workaround solutions

- Advise on local invoicing requirements and obligations

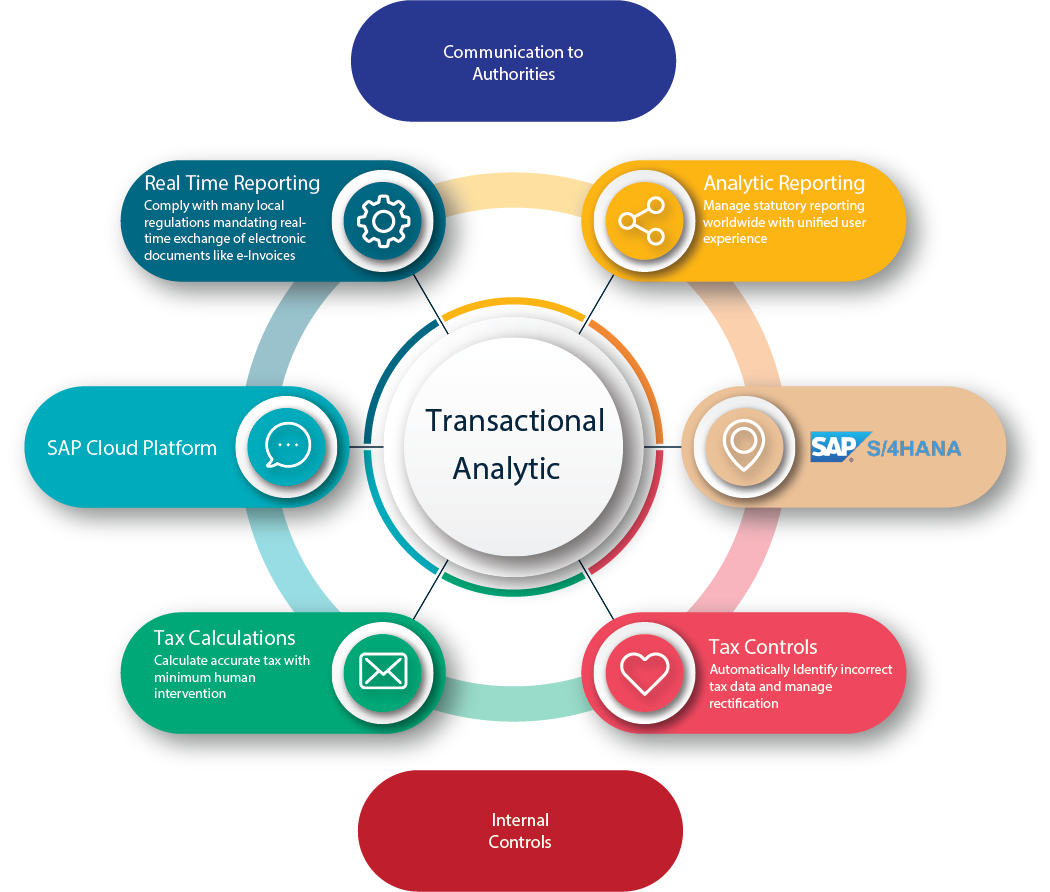

- Automating tax processes, workflows, authorisation and decisions in ERP systems

- Test scripts – Creation of taxation scenarios,

- Testing of taxation scenarios and taxation logic in the systems

- Providing post go-live support

Nexus subject matter experts have the hands-on experience of SAP S/4 HANA localization and complete detailed knowledge of the appropriate requirements; therefore, they guide through new implementations, migrations or upgrades of ERP systems.

- Clearly comprehend local country rules and laws

- Capturing of all country definite requirements and implemented right in the system

- Elaborate Processes testing by SMEs before go-live date, ensuring local compliance

- We cover multiple elements of the ERP localization projects and act as a one-stop shop for businesses seeking support with statutory requirements in multiple jurisdictions.